Home > Family Office

Family Office

Simplifying things for you & your family

A Family Office acts as a structure through which families manage their affairs. Often, it serves as an intermediary between the client and other service providers such as lawyers, investment managers, accountants, and government officials. This simplifies things for the family members.

Why set up a family office in Singapore?

Located at the heart of Southeast Asia

Singapore provides excellent global connectivity to serve fast-growing markets in the Asia-Pacific region and beyond. Adjacent to local and global private banks, investment banks and other financial service providers, Singapore is regarded as one of the most prominent financial centres in the region.

Stable governance & business environment

Singapore is also ranked amongst the top for political stability, ease of running a business, safety, and school quality. All these factors come together to help create a stable environment for a family to settle down on this little red dot. It is a preferred country for many high net worth families to manage assets and invest globally.

How does a typical family office structure look like?

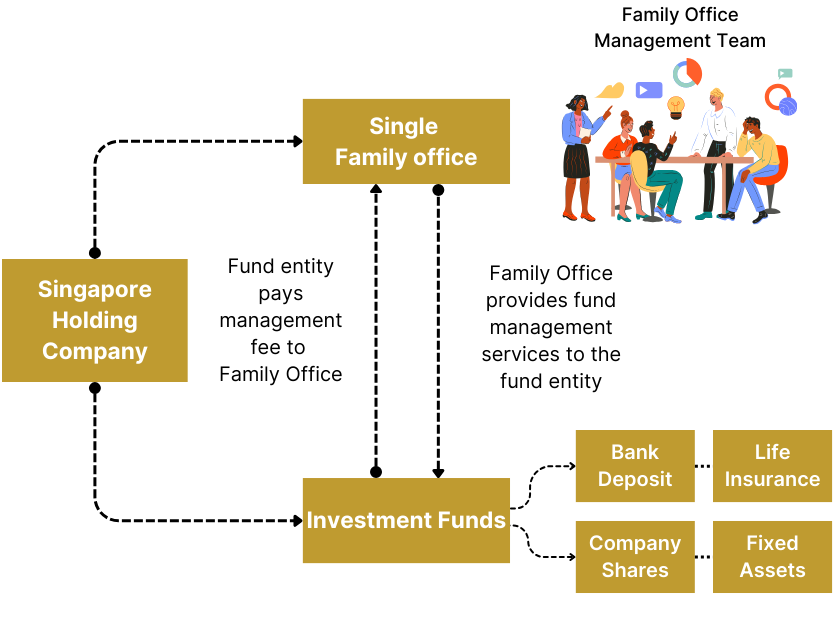

A SFO generally refers to an entity that manages assets for or on behalf of a family and is wholly owned or controlled by the members of the same family. A simplified illustration of a typical Family Office structure is shown here:

The number of Single Family offices (SFOs) established in Singapore has grown to 200 in recent years and this number is still increasing. Industry research estimates that each SFO typically manages assets in excess of US$100 million (S$136 million), with total assets under management by SFOs in the Republic amounting to US $20 billion (S$27.2 billion).

What services can a family office provide you with?

A SFO typically conducts various activities to facilitate the day-to-day management of a family’s assets. The activities involved are diverse and would include the following though the list is non-exhaustive.

Bookkeeping &

Accounting

Business Creation & Management

Tax Reporting

Charity & Philanthropy

Wealth Management

Risk Management & Tax Planning

Application for Permanent Residency/ Employment Pass/ Dependent Pass

Real Estate Management

Human Resource & Payroll Management

What are the steps to setting up a family office?

Want to start but not sure where or how to? Fret not! We are here to guide you every single step of the way and answer all your queries! Here we have listed the steps to setting up a Family Office in Singapore to give you a better idea of how we do things at Corecentric.

Step 1 : Establish your family charter

This includes setting your Family’s vision, goals, involvement, and any ideals that you would like to incorporate into your Family Office.

Step 2 : Determine which assets are to be controlled by your family office

Each family has different types of investments and assets to be managed, and we can create a customised solution for every Family Office.

Step 3 : Choose your services

After coming up with a customised solution for you, we will work together with you to determine the services you need.

The list of services may include:

- Administrative Duties (such as Secretarial services, Planning, Budgeting)

- Tax Services

- Legal Services

- Wealth Management (such as Investments)

- Business Creation and Management

- Advisory Services

- Investment Education

- Payroll and Human Resources

- Property Management

*This list is non-exhaustive and the services provided may be customized to suit your needs.

Step 4 : Determine your family office structure, operating costs, budget, and business plan

These factors will set the framework for the Family Office’s future and should ideally be discussed with an experienced advisor like Corecentric.

Step 5 : Structure your family office

Singapore allows corporations to reduce or waive taxes on specified income, and this is done through Family Offices in Singapore. However, there are certain criteria to be met, such as hiring of local staff, local spending on Goods and Services, as well as investments. Thus, it is important that you are properly guided to maximise your benefits.

Step 6 : Recruitment of staff

In order to properly meet your Family Office’s needs, it is best to recruit the appropriate staff so that they are able to provide you with the services that you have selected. We can guide you through the recruitment process or even source for the most suitable candidates for the job on your behalf!

Step 7 : Set up your infrastructure

Even the most competent employee requires infrastructure to work effectively. This can range from physical products – such as desks, computers and Wifi routers – to intangible products such as Standard Operating Procedures (SOPs), policies, and workflows. Corecentric can help to put these infrastructures in place so you don’t have to worry or stress yourself over it.

Step 8 : Monitor and review

After setting up your Family Office, it is necessary to monitor any changes, and adjust it accordingly depending on your needs. We will review your Family Office structure and its functions with you and if you would like to expand into other fields or for your Family Office to offer other functions, we can do that for you too!

Need our help?

Get started today

Discover how our expert consulting can transform your business.